Winners and losers in e-commerce

The pandemic saw a startling change in consumer behaviour trends. Who were the winners and losers?

Facilitated by advancements in mobile technology, site design, online payment methods and a maturity in digital marketing techniques from social to affiliate, it is common knowledge that e-commerce figures and online traffic have been steadily increasing for years.

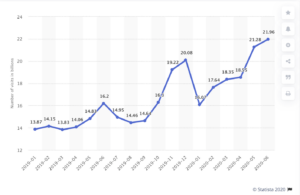

The figures for 2020 however, were startling. Whilst many of us already use the Amazons of the world with some degree of regularity, coronavirus has driven customers out of the high street and online in their droves. In January 2020, online retail sites generated 16.07bn global visits. By June 2020, this figure had ballooned to almost 22bn, a 35% YOY increase.

So how did the different sectors fare against one another?

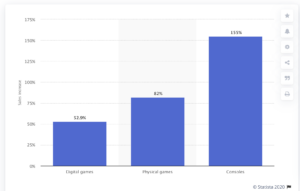

The games industry has seen sales increase significantly; in June 2020 total spending was at its highest since 2009, standing at $1.2bn and up by 26% compared to the same period last year.

Online fashion retailer ASOS “more than quadrupled profits during lockdown” adding 3m more customers to a base which now totals 23.4m. Online retailer Amazon saw over 5.2 billion unique visitors in June 2020 alone.

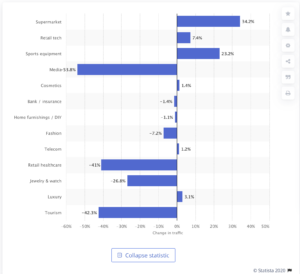

And it’s not just the producers and online stores themselves which are benefiting. Aggregators and affiliate marketing businesses are also enjoying a bumper period, as a result of the huge increase in online traffic. Whilst holidays and travel have fallen off a cliff edge, areas such as home fitness, home improvement and essentials have increased so significantly, in many cases they have counter-balanced the loss makers.

The high street has not fared so well. Footfall across UK retail destinations is down by 38% overall, leading to numerous store closures or workforce redundancies. PWC recently reported the closure of 11,120 chain store outlets, between January and June 2020. As part of a £55m cost saving drive, Burberry announced 500 job cuts, Selfridges cut 450 jobs, Harrods 670 staff. John Lewis has just announced plans to build rental homes at 20 of its sites around the UK, while also investing £1bn to extend its online services, after forecasting 70% of its sales are likely to be online within five years.

As industries, live entertainment and hospitality have arguably been hit the hardest. Many venues and businesses have closed their doors for good, and countless staff, creatives, and performers have found themselves out of work.

Oxford Economics has issued a warning of a projected 400,000 job losses and a £74bn loss in annual revenue across the UK arts industry. It has, however, been heartening to see many performers and venues switch to streaming their performances and events online, via Twitch, Facebook, Zoom and many other means, for either a small fee, or via a donation link. Whilst no substitute for being allowed to operate in a real location (and clearly missing any benefit of ancillary revenue), this is just another example of businesses reacting to the pandemic, and benefitting from changing attitudes to ecommerce.

These are indeed uncertain times. Some industries are thriving – Eleanor, Matt and Olivia have all recently written about the boon in e-learning, for example – and those which can are quickly adapting and changing their business models to fit into a new world (here at MTA we are currently helping a number of businesses do just that). But even within these booming industries, there are certain businesses outstripping their rivals.

In a great summary of the state of the US retail sector, Modern Retail explained just why some brands are thriving while others in the same sector are suffering. Clearly, the readiness of their digital offering and its ease of use are huge factors; but the drivers of click-and-collect, and the growth of brands going direct-to-consumer (DTC) are equally important.

As an example, Lululemon, a traditionally bricks-and-mortar sportswear brand, saw an overall growth of 2% in its business in the second quarter, with online sales growing 157%, and DTC sales increasing from 24.6% of its business to 61.4%. Yet, at the same time, its rival Under Armour lost 40% of revenues and saw DTC sales drop 13%.

Business models are changing fast. As we have said before, success will come to those who can cultivate new habits in their users: those that lag behind will struggle. While some degree of normality will return to the sectors that rely on social interaction (hospitality, entertainment, and so on) it is much less likely that the same can be said of retail. Those that innovate best will outstrip their rivals. Those that fail to invest in digital solutions are likely to struggle.

James Dodd

Martin Tripp Associates is a London-based executive search consultancy. While we are best-known for our work across the media, information, technology, communications and entertainment sectors, we have also worked with some of the world’s biggest brands on challenging senior positions. Feel free to contact us to discuss any of the issues raised in this blog.