Why challenges to China’s video games industry matter in Europe and the US

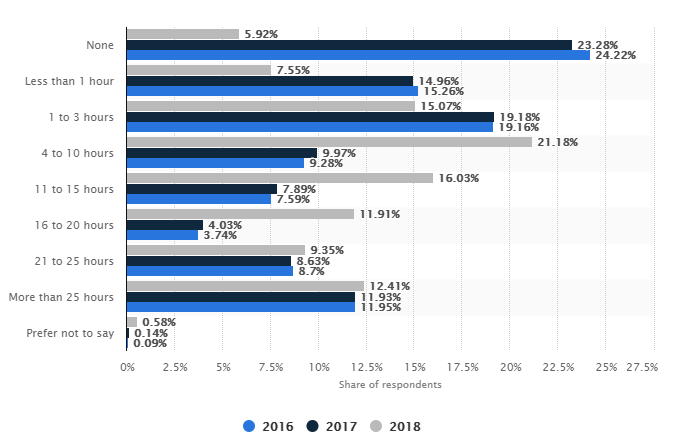

China’s video games industry is experiencing its slowest growth in at least a decade and a half, despite evidence that the country’s gamers are spending more of their time playing games (see graph below). The world’s largest games market, worth some $32.5bn a year, is in the midst of a huge shake-up. Beijing has sought to limit the industry, alluding to growing concerns over the health of video gamers, addiction issues and questionable content and commercial practices. As often happens in totalitarian regimes, the assault has been multi-pronged:

- Citing worries about youth eyesight, in March the Ministry of Education introduced a plan to restrict the release of new online video games and develop an age restriction system. As a result, Tencent had to withdraw its online role-play game (RPG), Monster Hunter: World, resulting in refunds of $43m and $16bn being wiped off the value of its shares.

- At the same time, the Chinese Ministry of Culture brought in new rules surrounding loot boxes in videogames, citing the need to protect user’s rights and wellbeing. These rules forced developers to reveal the odds of players receiving items – or ‘winning’.

- In August, regulators removed the “green channel”, a loophole which allowed developers and publishers to apply for their video games to be distributed for a month-long testing period, during which the software could be monetised.

- A shake-up at the top of Cyberspace Administration in China (CAC), the country’s leading internet sensor – best known for banning Facebook, Google, Instagram, and Twitter – has seen Zhuang Rongwen appointed as CEO. Rongwen is a Communist Party stalwart who previously led much of the Party’s propaganda efforts.

As a result of these actions, Tencent – the country’s leading video games conglomerate – has seen its shares fall from a high of $474 in January of this year to $270 at the beginning of this week, a fall of over 43%.

So why does this matter to developers and publishers outside China? Well, for a start Tencent owns over 40% of Fortnite developer Epic Games. It also owns at least 1.5% of PUBG developer Bluehole, and had been planning to increase its stake significantly before the flurry of announcements: its investment efforts seem to have fallen by the wayside as a result of its collapsing stock price.

Titles by EA, Activision Blizzard and Capcom – some of gaming’s biggest developers – may also be affected as they are distributed throughout China by either Tencent, or another of China’s internet technology companies, NetEase Inc. NetEase’s share price has also lost over 40% in a similar timescale.

With over 50m Chinese users playing PUBG alone, the threat to access to the Chinese market is a worry, particularly for the indies. To an extent large, conglomerate-backed developers may be in a position to absorb a slower trading environment; cash-poor indie developers are far less likely to be able to withstand a downturn.

Even so, it could still be construed as a largely local and containable threat if all of China’s actions were unilateral. But it may be that they are not alone. Many other government bodies, for example, are looking at the issue of loot boxes.

In April, Eurogamer reported that European authorities were conducting investigations into how to regulate these in-game purchases. The Dutch Gaming Authority declared that loot boxes in four out of the ten games it tested contravened its Betting and Gaming Act, equating them to gambling. The games in question turned out to be FIFA 18, Dota (which featured in my earlier AI blog), Rocket League and yes, PUBG. Later that month the Belgian Gaming Commission came to a similar conclusion, specifically outlining a concern for the well-being of young people. It declared loot boxes in several video games equated to gambling and were therefore illegal. This led to a demand to remove the loot boxes or “risk a prison sentence of up to five years and a fine of up to EUR800,000.”

There is a balance to be struck here. Obviously, it is hugely important to the industry that gamers remain both physically and mentally healthy. Every developer, publisher and distributor should take this into consideration when developing revenue models for their titles. But gamers also want ‘free’ games uninterrupted by advertising: in-game purchases have proved a successful ploy to square the circle.

But the industry needs to be sensitive to legitimate concerns. Approaches such as loot boxes, which blur the lines between playing a video game and gambling real world cash, may make developers enormous sums of cash in the short term, but could unequivocally damage the industry in the long term. Right now, it is this controversy which links us to China. How long until other countries follow China’s lead and begin clamping down on the release of new games, citing health and vision concerns, or worse?

The industry needs to be much more proactive in explaining to legislators the challenges it faces. For example, most governments and legislative bodies simply don’t have a clear enough understanding of the mechanics of monetising the industry: few seem to comprehend the difference between a legitimate in-game purchase and gambling on a loot box, particularly when the definition of what constitutes a loot box can be so fluid. It only takes a few more issues to remain similarly opaque to regulators for trouble to follow.

To put it succinctly, the industry needs to take control of its own Destiny; otherwise it might find itself Forsaken.

James Dodd

Martin Tripp Associates is a London-based executive search consultancy. While we are best-known for our work across the media, information, technology, communications and entertainment sectors, including video games recruitment, we have also worked with some of the world’s biggest brands on challenging senior positions. Feel free to contact us to discuss any of the issues raised in this blog.