How publishers can wake from the digital dream

Is the digital dream over for publishers? This week news out of BuzzFeed, VICE and Mashable indicated that might be so, and the rhetoric from media analysts suggested a mass awakening for those who hoped digital advertising alone could be the basis for a media business.

The Wall Street Journal reported that BuzzFeed – long the poster child for success in digital – would miss its projected $350 million revenue target for this year by up to 20 percent. At the same time it reported that VICE, frequently cited as an example of how to transition from print to a primarily-digital publisher – would likely miss its own revenue targets. Most significantly, Mashable sold to Ziff Davis for $50 million, far less than its 2016 valuation of $250 million.

That effectively puts paid to BuzzFeed’s long-rumoured 2018 IPO, even after the site opened the door to banner advertising in August of this year, a move designed to bolster its revenue generating potential as the native advertising space becomes more crowded and the domain of the brands themselves. It’s hardly the end of the world for BuzzFeed, as its revenue continues to grow, but all together that news represents a cooling of publishers’ ardour for digital advertising as a main revenue source.

MarketWatch Tech Editor Jeremy C Owens said:

News in just the last few minutes:

– Buzzfeed missing revenue targets by 15%-20%, IPO next year unlikely

– Mashable selling for 20% of its 2016 valuation

– Vice missing revenue target

– NerdWallet laying off 11% of staff after missing profit targetsNew media becomes old media

— Jeremy C. Owens (@jowens510) November 16, 2017

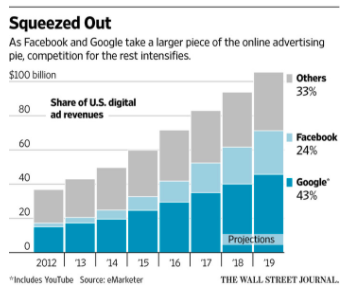

The harsh reality that publishers are acknowledging this week is that, despite an overall growth in digital advertising, digital ad dollars alone cannot sustain a publishing business. The size of the cake is increasing, but publishers’ slices are getting smaller. And people are quick to point the finger of blame at the duopoly of Google and Facebook. Last Thursday, Guardian editor Katherine Viner said:

“For a time, it seemed that the potentially vast scale of an online audience might compensate for the decline in print readers and advertisers. But this business model is currently collapsing, as Facebook and Google swallow digital advertising; as a result, the digital journalism produced by many news organisations has become less and less meaningful.”

The need to dance to the Duopoly’s tune has led publishers to produce content on the platforms’ terms, rather than their own. That race to the bottom, the generalised scale-for-scale’s-sake that led many publishers to produce homogenised seen-it-before content, has been going on for years, as this thread by Skift co-founder Rafat Ali makes clear:

This was the day Mashable signed its slow-slide-to-irrelevance contract. When it became everything for everyone. Six years ago. https://t.co/KNuVGotEqr

— Rafat Ali (@rafat) November 19, 2017

Writing for Talking Points Memo, Josh Marshall goes so far as to explicitly call this a ‘crash’ – even if nobody else can bring themselves to say it.

But, as discussed in this week’s ‘Death of Digital’ special episode of Media Voices, that might ultimately be a good thing. While there will be turmoil in the short-term as the VC funds that have perpetually sustained media businesses as they grew to huge scale stop seeing them as a guaranteed source of return, there are green shoots that suggest media businesses have realised digital advertising shouldn’t be their main focus.

And, as DCN’s Jason Kint points out, overall digital revenue including subscriptions at premium, quality publishers is actually continuing to grow (incrementally). It suggests that publishers who didn’t abandon their mission and join that chase to the bottom are relatively well placed to make money from digital – just not from digital advertising alone.

I know industry is frantic about “media apocalypse” but I’m poring over @dcnorg Q3 member report I just received today…and not seeing it. Growth climbing, best quarter yet. Revenue diversification plus advertisers flight to quality (finally)? clearer skies ahead. h/t @Randeloo pic.twitter.com/O5YIIn8onG

— Jason Kint (@jason_kint) November 17, 2017

Instead, those publishers that are most deserving of admiration are those who have realised the strongest strategy has several columns. Whether that’s e-commerce, events, niche print, native advertising… all those revenue strands have their own challenges, but together each strand can support and strengthen the others.

So while Shane Smith’s long-promised ‘bloodbath’ in digital media might be upon us, there is at least the suggestion that the publishers who survive it will be leaner, meaner and more adaptable. In order to be one of those more evolved media business, digital businesses needs to do the following:

– Rip the platform plaster off: While the allure of huge scale is easy to understand, this week has definitively demonstrated that over-reliance on platforms to deliver scale and ad money is a mistake, and erodes the purpose of a brand.

– Understand that industry trends like the ‘pivot to video’ are only likely to deliver value in the short-term – at least until distribution channels like Facebook turn the spigot off.

– Regard VC funding with a bit more wariness. As Skift’s Rafat Ali has been arguing for years, media businesses who accept VC lucre are effectively reliant on regular cash injections to appear healthy, even as their underlying business models struggle to match that apparent wellness.

As ever, smart businesses win.