How media brands build successful e-commerce strategies

It’s not enough for media businesses to be a one-trick pony any more. Outside of the rare Nordic publishers who got into online classifieds early, there are few companies of significant scale who can sustain themselves only through advertising.

While some have gone the business information route, like Skift and other companies in high-value verticals like travel or fashion, an increasing number of media companies are placing their faith in e-commerce.

Put simply, organisations like BuzzFeed and Refinery29 are betting on the relationship with readers and ecosystems they’ve created on their own sites to sell products. There are a number of ways publishers are going about that, whether it’s using an e-commerce platform like Shopify to sell directly on site (and increasingly sophisticated marketing tools) or through affiliate links, e-commerce is an ever more important focus for publishers. However, that relies on publishers proving their expertise in the verticals in which they want to sell.

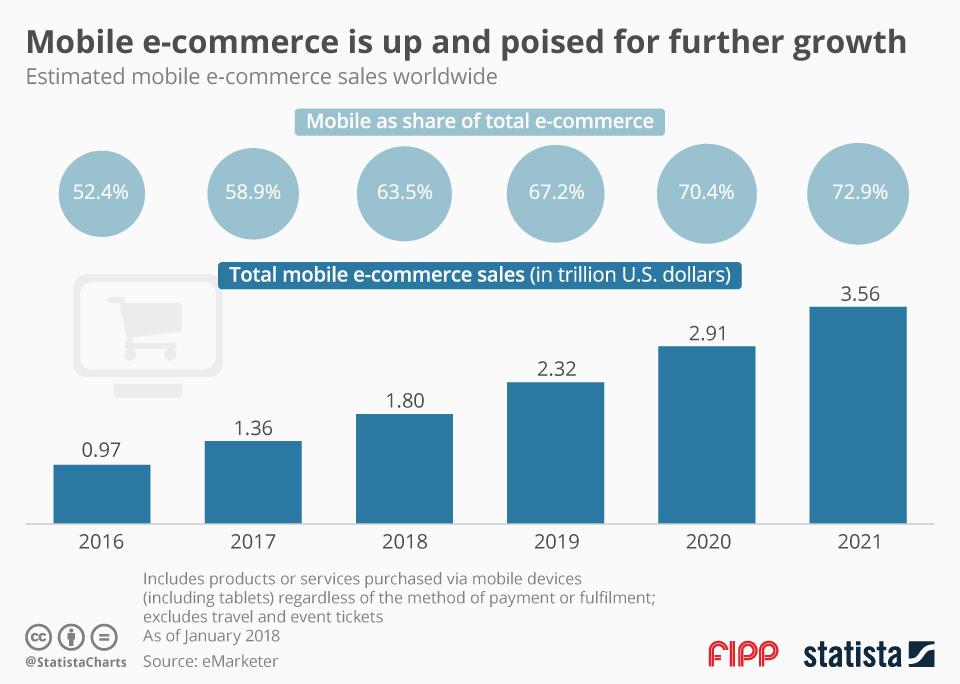

That’s particularly true as audiences transition into mobile consumption of content. According to eMarketer estimates, retail e-commerce sales reached US$2.3 trillion in 2017, a 23.2 per cent increase over the previous year, and much of that is driven by purchasing being made easier through mobile devices. The success of WeChat in China has demonstrated that audiences have become habituated to purchasing via their phones and, while Western audiences aren’t quite so used to an all-in-one ecosystem like WeChat, research from FIPP demonstrates that mobile e-commerce is poised for significant growth.

The big UK success story for e-commerce is undoubtedly Dennis, whose acquisition of buyacar.co.uk has been feted as prescient given the acceleration of trends around digital advertising that occurred immediately afterwards. Digiday reported in March that Dennis was set to make $83 million from car sales alone this year, which will account for 45 percent of its total revenues for the year. It has the benefit, through its existing automotive titles, of owning the entire customer buying process.

That wholesale acquisition of an existing, lucrative, big-ticket e-commerce site is a strategy that few publishers will have the funds to pursue. Instead, they might choose to pursue acquisitions like the New York Times did with Wirecutter back in 2016 (link via the NYT, so count your remaining free articles carefully before clicking). Though less ambitious than the buyacar acquisition, it still relies upon the relationship that the publisher has with an audience it has cultivated around those verticals. The CEO of the NYT Mark Thompson said:

“The practical approach that The Wirecutter and The Sweethome take to product recommendations embodies the same standards and values that are the pillars of our own newsroom. Their service-focused guides align with our commitment to creating products that are an indispensable part of our readers’ lives.”

Given the growth in ecommerce, it’s unsurprising that platforms as well as publishers are looking to take advantage of it. The beleaguered Snapchat is testing a commerce function with a bunch of Discover publishers – the ones who it believes have that special relationship with readers. It has also traded on its own relationship with its users through partnerships with Nike. That, and Facebook’s own attempts to corner the e-commerce market, is likely to upset some publishers, who remember the last time a platform inserted itself between them and the audiences they were trying to monetise.

Ultimately, then, the infrastructure required for media businesses to truly benefit from e-commerce can be bought, or licensed, in any number of different ways. But the relationship between an audience and the companies who want to monetise them through e-commerce is the oldest strength in the publisher playbook, and one we’ll see brought to bear more and more in the coming years.

enquiries@trippassociates.co.uk

Martin Tripp Associates is a London-based executive search consultancy. While we are best-known for our work in the TMT (technology, media, and telecoms) space, we have also worked with some of the world’s biggest brands on challenging senior positions. Feel free to contact us to discuss any of the issues raised in this blog.