Amazon, ecommerce, and opportunities for publishers

This week The Washington Post announced its ambitious plans for broadcasting on Twitch. In acknowledgement of Twitch’s primary audience, one of its two new shows will feature hosts from the Post playing video games alongside politicians, an idea that has ‘Steve Buscemi in 30 Rock‘ written all over it. The other show is set to be an irregularly scheduled live news show – and we’ve spoken about the challenges around digital news video before.

So far much of the coverage of the deal has been around the implications for other publishers looking to reach new audiences on livestreaming platforms, or about what this says about The Washington Post’s commitment to finding new audiences despite its paywall. But something that has been lost in the noise is that Twitch offers its creators both ecommerce and advertising revenue – and its owner, Amazon, stands to benefit from both. Considering that Jeff Bezos, Amazon founder, also owns the Post, this seems to be another example of Amazon leveraging potential mutually beneficial partnerships between its properties.

This pattern of dominant revenue sharing is an Amazon trope. For example, back in 2017, Twitch opened an Affiliate scheme that let users purchase games directly through a streamers’ channel, for which it takes a cut. Amazon utterly dominates the ecommerce world, being far and away the largest possible ecommerce provider on the planet.

.@amazon is set to clear $258.22B in U.S. retail sales in 2018. That works out to 49.1% of all online retail spending in the U.S., and 5% of all retail sales https://t.co/9nHePjMTbg pic.twitter.com/IbRoUVa1v0

— TechCrunch (@TechCrunch) July 16, 2018

That, as Dennis Publishing astutely noted when it bought buyacar a few years ago, effectively makes it very tricky for publishers outside the Amazon ecosystem to compete with it in any way but cornering a smallish but high-value part of the market.

However, given Amazon’s position within the market, it’s possible that publishers won’t see Amazon’s ecommerce dominance as a threat, but an opportunity. After all, with its expertise in discovering and sourcing products to consumers, based on its wealth of first-party user data, it could potentially sell subscriptions to publishers’ own work more effectively than they could do on their own. Its Subscribe With Amazon service, for instance, was launched with the explicit marketing message that it would give publishers better terms for selling subscriptions than any of its competitors.

Amazon already dominates the worlds of ecommerce and subscription selling to the point that publishers, whose businesses depend on these revenue streams, may well consider ceding their channels to the behemoth. But Amazon also has aspirations to own a space that publishers have largely already conceded to the Duopoly.

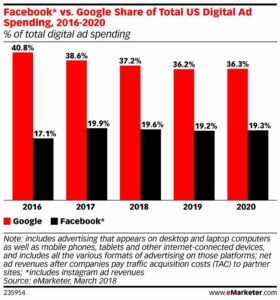

Because of the huge amounts of user data to which it has access – data which translates more directly to purchasing intent than either Google or Facebook can marshal, many commentators are speculating that Amazon will soon be in a position to steal significant amounts of revenue from the search and social giants.

In April of this year, for instance, its ‘other’ revenue hit $2billion for the first quarter of the year. While it doesn’t break out ad sales separately, it did note that digital advertising made up the vast majority of that ‘other’ category. That translates to a 72 percent increase from the same quarter last year, and eMarketer also suggests that Amazon could surpass Microsoft and Oath by 2020 in terms of ad revenue.

So, while the Duopoly occupies the lion’s share of publisher mindshare, it’s likely that by this time next year Amazon will be spoken of in much the same way. That said, if publishers’ relationship with the Duopoly is anything to go by, it’s unlikely that their relationship with Amazon will be wholly positive – particularly since the retail giant also dominates the ecommerce and digital subscription ecosystems.

enquiries@trippassociates.co.uk

Martin Tripp Associates is a London-based executive search consultancy. While we are best-known for our work in the TMT (technology, media, and telecoms) space, we have also worked with some of the world’s biggest brands on challenging senior positions. Feel free to contact us to discuss any of the issues raised in this blog.